The Year for Action: 5 Electronic Communications Security & Compliance Trends for 2018

In 2017 we saw an injection of corporate spend and significant planning in preparation for addressing regulations coming into effect in 2018 – specifically, MiFID II and GDPR. As well, an ever-increasing demand for more effective and efficient electronic communications compliance engendered new levels of focus on how Fintech technology can help. No matter the political climate we are predicting in 2018, regulatory bodies will expect corporations to not only demonstrate adherence to these new regulations but also improve their responsiveness to inquiries.

Corporations, if not already doing so, must realize that digital transformation must be an essential part of their operating models to operate at the speed of markets today. No industry is immune from this necessity, but financial services must be the most vigilant. It’s expected 2018 will be a year of more cyber threats and corporate intellectual property theft, with other security breaches at an all-time high.

With 2018 as a year of proving compliance adherence, and where digital transformation is driving business demand for the adoption of the latest communication technology, you need to keep these five trends top of mind.

- Cyber Attacks will be at an all-time high. Attackers are looking at new ways to penetrate corporations as they allow more broad-scale federation external parties over Instant Messaging (IM) and other collaboration tools. While this is fantastic progress and an important component to digital transformation, it opens questions about how well IT and security departments are ensuring these new communications channels have the necessary protections in place that we’ve become accustomed to with email. As email protection technology has vastly improved – protecting firms from internal and external threats with data loss prevention solutions – it is expected that bad actors will begin to target newer technologies in the areas of real-time communications and collaboration. If your corporation is using Skype for Business, CISCO, and cloud solutions such as Slack, or Microsoft Teams, you must ensure that you are using the latest security technologies to protect your firm from new external and internal threats as users move sensitive content to these channels as part of their business process.

- Financial Services firms are expected to be ready and able to demonstrate that they are MiFID II compliant. Piecing together and reconstructing trade events with ecommunications within the 72-hour regulatory SLA window is expected to be tested at scale in 2018. To meet global regulations, regulated entities are realizing that a combination of data science and technology solutions are key in helping them identify areas of risk. Firms should avail themselves of best-of-breed systems that have open access to datasets for sophisticated, post- and near real time data analysis, allowing them to automate the threading and reconstruction of conversations with minimal manual labor. With regulations like MiFID II and GDPR top of mind in 2018, trusted immutable data and open access to data repositories will play a central role in compliance efforts.

- Superior insights the appeal of faster and better information access is no longer a nice-to-have, but now mandatory for firms looking to deliver superior insights to improve the customer experience, and marketing programs that go beyond traditional compliance surveillance. The explosion in the volume of data, especially in electronic communications, will continue to grow exponentially as firms leverage new tools internally and externally to improve employee productivity Advanced analytics and data management capabilities that leverage these datasets will also radically help drive innovative insights for line of business applications. For this to happen, firms need to have an unfettered, Open API and fast access to reliable, trusted datasets.

- Artificial Intelligence (AI) is transforming business processes and reducing demand on labor in mundane electronic communications compliance workflows. AI was a common 2017 technology story with the nature of the technologies themselves being the narrative. But in 2018 we expect to see the conversation evolve to how AI will be applied to help corporations attack increasing workloads such as regulatory supervision and surveillance, conduct more frequent security governance posture reviews by understanding sentiment, detecting stress, tone and personal information (per GDPR), and compare current user behavior against a historical baseline. With the right technology partnerships corporations will be able to realize unparalleled speed and agility, providing efficient compliance review and relevant eDiscovery results that may have once required an army of offshore people to process.

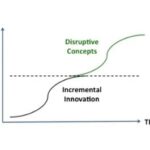

- Blockchain-based ledgers are expected to become more widespread. While blockchain technology may still be viewed by some as disruptive, its potential to increase trust and transparency in financial transactions and communications across groups is gradually becoming more understood. The Monetary Authority of Singapore and the Australian Securities Exchange are both exploring blockchain’s application for the clearing and settlement of financial events, while the Hong Kong Monetary Authority is developing a blockchain-based platform for trade finance. In these and other projects, we are seeing the move from disruption to adoption across the industry. At Indecium we are working with others in the ComChain Alliance on the applicability for non-reputable electronic communications.

As we move into the new year we can expect to see some of the new regulations tested in non-theoretical settings especially in Europe with MiFID II and GDPR. And as companies adopt new forms of communication and collaboration technologies with external party connectivity, security, data protection, and governance need to remain front and center with every implementation. One final trend I see forming in 2018 is how corporations will start realizing the potential of machine learning technologies against datasets such as unstructured electronic communications to aid in revenue generating activities. With the right immutable data store technologies, what was once seen as cost of doing business will open up a world of innovation that ultimately benefits firms and their customers in a practical and meaningful way